In the ever-evolving landscape of modern finance, Know Your Customer (KYC) regulations have become an indispensable part of ensuring transparency, security, and regulatory compliance. With the advent of digital transactions and the globalization ekyc hong kong of financial services, verifying the identities of customers has emerged as a crucial aspect of risk management for banks and financial institutions worldwide.

KYC regulations mandate that financial entities meticulously authenticate the identities of their customers before initiating any transactions. This thorough verification process involves collecting comprehensive personal information such as names, addresses, dates of birth, and official identification documents. Additionally, KYC protocols often necessitate screening customers against various watchlists to proactively identify potential risks or suspicious activities.

The overarching goal of KYC regulations is to combat financial crimes, including money laundering, terrorist financing, and fraud. By establishing robust identity verification processes and implementing continuous transaction monitoring mechanisms, financial institutions can promptly detect and report any suspicious behavior to the relevant authorities, thereby safeguarding the integrity of the financial system.

However, implementing effective KYC procedures presents significant challenges for financial institutions. The sheer volume of customers and transactions, coupled with the evolving regulatory landscape, renders manual KYC processes impractical and error-prone. These manual processes are labor-intensive, time-consuming, and ultimately unsustainable in today’s fast-paced financial environment.

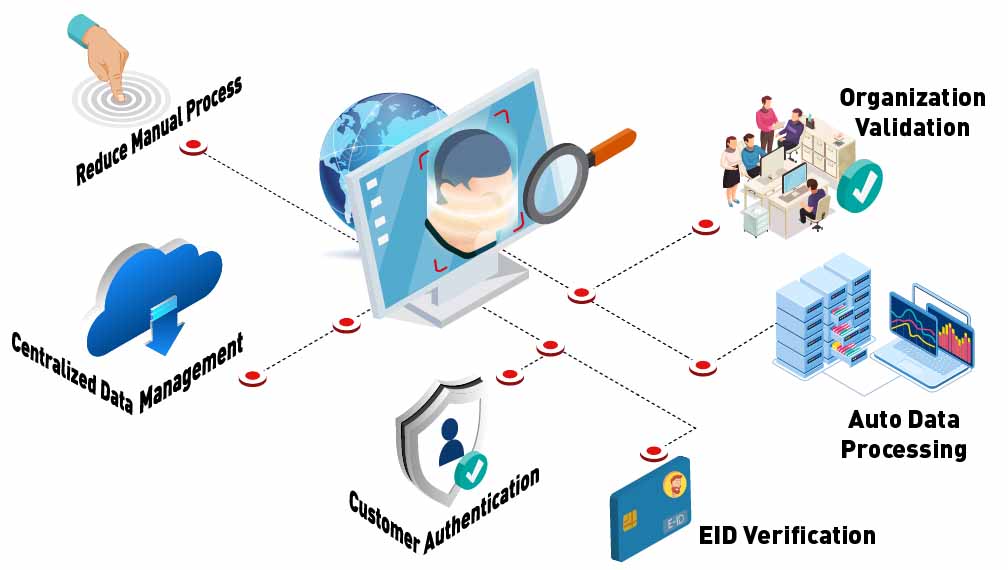

To address these challenges, an increasing number of financial institutions are turning to automated KYC solutions driven by advanced technologies such as artificial intelligence and machine learning. These solutions streamline the KYC process by automating data collection, verification, and risk assessment, thereby reducing manual intervention and enhancing accuracy.

Automated KYC solutions utilize various techniques to verify customer identities and detect suspicious activities. These techniques encompass document verification, biometric authentication, behavioral analysis, and pattern recognition. By analyzing vast datasets in real-time, these solutions can swiftly identify potential risks and flag them for further investigation.

Moreover, automated KYC solutions offer scalability and flexibility, enabling financial institutions to adapt to changing regulatory requirements and accommodate growing transaction volumes. Additionally, they improve the customer experience by minimizing wait times and reducing reliance on manual paperwork.

Despite the benefits of automated KYC solutions, financial institutions must remain vigilant to ensure compliance with regulatory mandates and protect customer data privacy. It is essential to implement robust security measures to safeguard sensitive information and mitigate the risk of unauthorized access or data breaches.

In conclusion, KYC regulations play a pivotal role in upholding the integrity and stability of the global financial system. Automated KYC solutions represent a promising avenue for financial institutions to streamline compliance efforts, enhance efficiency, and bolster risk management capabilities. By embracing advanced technologies, financial institutions can navigate regulatory challenges effectively and maintain trust in the financial services industry.